The Ministry of Defence is carrying on early major reforms as promised in the Labour (and, at least to a degree, also in the Tory) Manifesto pre-Elections. In particular, the figure of the National Armaments Director has been established, with responsibility for “harmonising procurement” to ensure best practices are followed in procurement and investment, included in working with wider government and international partners.

The NAD will also be key in pursuing export opportunities. The NAD is going to be a leading figure in the shaping and then delivering of the renewed Defence Industrial Strategy the Government has promised to launch. For the moment, the role of NAD has been bestowed onto the existing CEO of the Defence Equipment & Support agency (DE&S), Andy Start, but “a search for candidates is underway”.

It is hoped that the establishment of an overarching Armaments Director will deliver increased efficiency and performance in Defence procurement, although there is every reason to be doubtful. The establishment of a NAD in itself won’t alter the terms of the problems in Defence procurement, starting from the chronic short-termism of procurement decisions based on the need to balance the books year on year while juggling monolithic mega-programs stretching over decades with large orders placed in one go for lack of a more flexible and stable mechanism of long-term projects with annual orders.

While waiting for yet another Defence Industrial Strategy to be published, the British sector has been rattled by 2 companies disappearing in the space of a week.

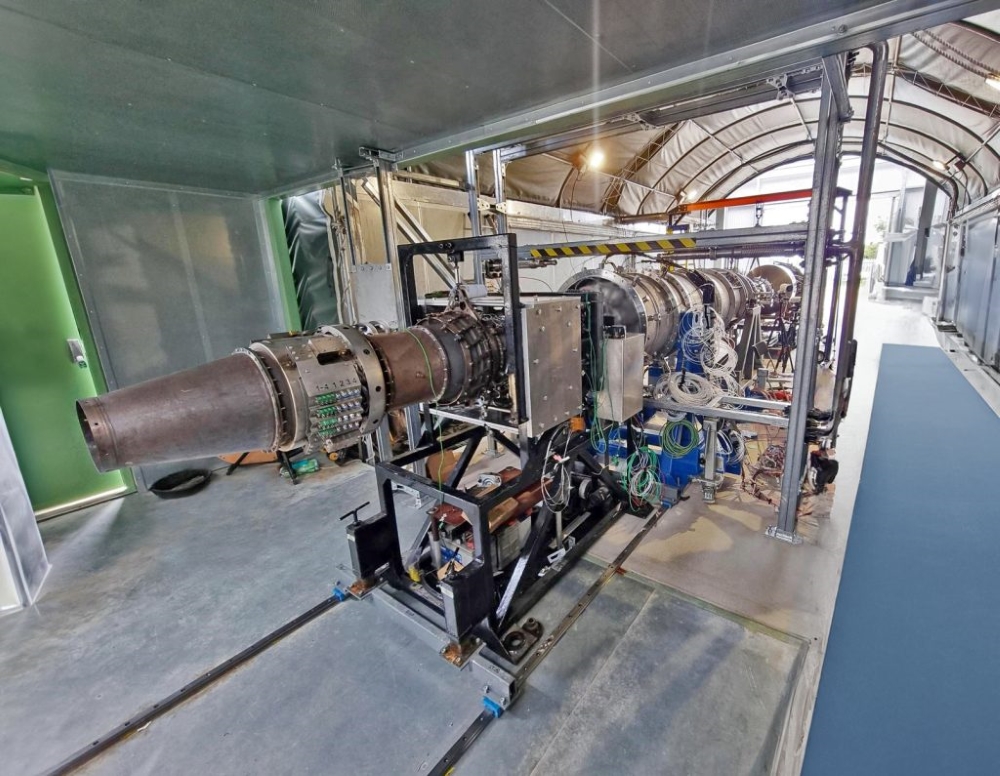

The first, excellent victim is Reaction Engines, the innovative company specialized in high-speed propulsion and heat transfer, known by most thanks to its long-term ambition of enabling the development of a single-stage-to-orbit spaceplane able to take off, accelerate to hypersonic speed on air-breathing engines and then make the jump into orbit. While progress on that most ambitious dream has been slow, Reaction Engine’s successful precooler, demonstrated at up to Mach 5 conditions, was finding more immediate applications in various studies for different applications. Most notably, just last August Reaction Engines had demonstrated Mach 3.5 operation of a modified Rolls Royce GNOME engine fitted with a scaled down version of its precooler. The old GNOME, originally built as a turboshaft, was converted to operate as a gas generator as part of this experiment, and thanks to the precooler matched, in the ground tests, the conditions of flight at the highest speeds recorded by the SR71 BLACKBIRD in its prime. The aim of this demonstration specifically was to eventually use the turbine-precooler combination to propel the vehicle from a standing start on the runway to a mode transition speed, probably close to Mach 4, at which point the engine would be cocooned with thrust provided by a ramjet/ramburner kicking in. This propulsion arrangement would have been key to the Royal Air Force’s Hypersonic Air Vehicle Experimental (HVX) program, launched in 2022. It is too soon to say what the impact will be of Reaction Engines ceasing operations. It will be interesting to see which elements of its technology will be bought and by what major primes. The company was eventually precipitated into administration after failing to secure some 20 million pounds in new investments. The Government felt no need to intervene, despite vowing to “monitor” its critical supply lines.

In the same week, another small and innovative company has ceased operating: Steller Systems, an independent consultancy specialising in Naval Architecture, has winded up operations after being hit by a petition from HM Revenue and Customs (HMRC) over unpaid debts. The impact on its employees was brutal as the end of the company was sudden. Just one week ago Steller had completed an important demo to the Royal Navy of an innovative inflatable “cage” for the launch and recovery of Uncrewed Underwater Vehicles from the otherwise unmodified crane of the HUNT-class minehunters. The cage is particularly being looked at to ease employment of the REMUS 300 UUV which in turn is to ensure deep water search capability to the HUNT class as the last SANDOWN-class ships are withdrawn from service. Based in Nailsworth, Gloucestershire, Steller Systems Ltd had earlier delivered an impressive demonstrator for an Offshore Insertion Craft believed to be driving thinking for the future Commando Insertion Craft the Royal Marines intend to procure from end 2026 as replacement for the current LCVP Mk5 landing craft.

Earlier still it was Harland & Wolff who fell into administration after failing to secure a £200m loan guarantee from UK Export Finance. On 27 September, Gavin Park and Matt Cowlishaw were appointed Joint Administrators. The firm, which was attempting to rebuild a sustainable business model with a series of investments, had become dependent on US lender Riverstone while waiting for government support that never arrived. The new Labour government said it would not put forward the guarantee as the was "a very substantial risk that taxpayer money would be lost". The Company’s subsidiaries, being the 4 major shipbuilding sites in Northern Ireland (Belfast), Scotland (Arnish and Methil) and England (Appledore) are not subject to insolvency processes and are continuing to trade under the control of their directors.

The Belfast shipyard, which boosts one of the biggest docks in Europe, is seeing a 70 million build program for new structures and machinery for steel lavorations ahead of its role in building and assemblying the 3 new Fleet Solid Support ships for the Royal Fleet Auxiliary. Harland & Wolff is the main sub-contractor of spanish group Navantia under the 1.6 billion pounds contract. Assembly of the circa 40,000 tons vessels is supposed to happen at Belfast, with the ships built from 3 super-blocks: the bows are to be built by H&W Appledore, the centre sections directly at Belfast, and elements of the keel and the stern super-block are to be built by Navantia at Cadiz. The erection of the steel structure for the fabrication hall extension was in March.

The FSS design has in the meanwhile passed its Preliminary Design Review, with build to begin next year. Belfast has also secured a number of important refits and dockings in supporto f civilian shipping and offshore support vessels. The Appledore shipyardin the meanwhile has been delivering regeneration work on SANDOWN minehunters the UK has sold to Lithuania and Romania and provided to Ukraine, and has just built a new anchor cable barge for Portsmouth’s naval dockyard.

H&W Arnish on the Isle of Lewis has a workforce of about 100 and specialist steelwork capabilities. It has worked on diverse projects including parts for Hinkley Point nuclear power station, pier construction and the mining industry. As for H&W Methill, with its two load-out quays, large open assembly area and a 7,500m² covered fabrication hall, the company was pushing to be selected for the construction of 2 new floating docks for nuclear submarine maintenance that the Royal Navy intends to procure for installation at Faslane (Project EUSTON).

So, while the shipyards have been securing several contracts, the financial side of the company has not been able to keep up. Now there is, inexorably, much uncertainty about the future direction. It has been suggested Navantia could buy all 4 yards.

Follow us on Telegram, Facebook and X.