The third edition of the Defence Exhibition Athens (DEFEA) officially opened today, May 6th 2025, at the Athens Metropolitan Expo, marking what promises to be a record-breaking event in terms of scale and international participation. With more than 430 exhibitors representing 37 countries—up from 315 exhibitors from 22 nations in 2023—the 2025 edition underscores the growing importance of the Hellenic defense market on the European and global stage.

The number of official delegations has seen a significant increase as well, with 98 delegations from 45 countries attending, nearly doubling the 55 delegations present in the previous edition. While final visitor figures will only be confirmed at the show’s conclusion, initial attendance on the first day suggests a substantial rise compared to the 12,000 recorded in 2023.

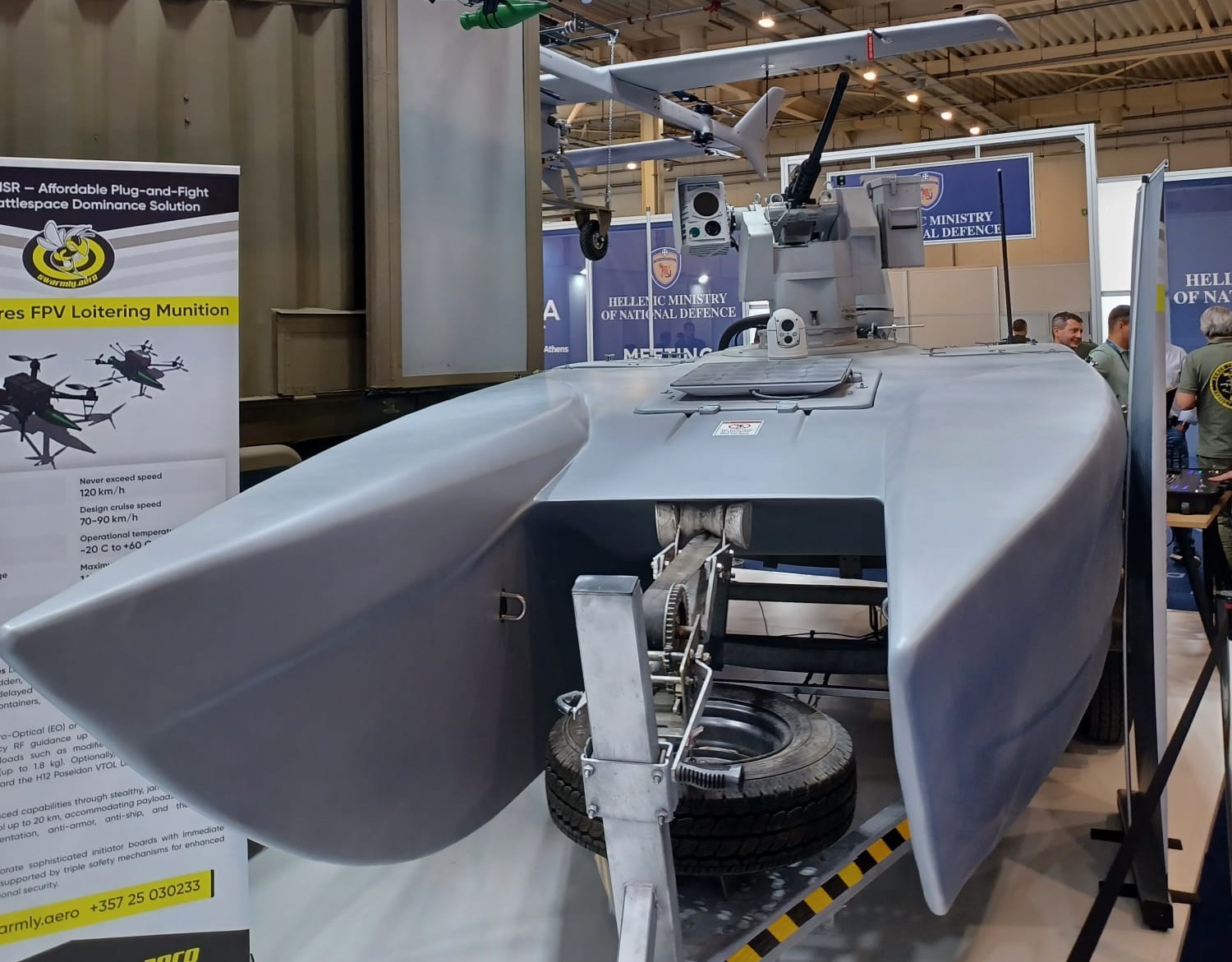

Notable among the participants is the robust French and Israeli presence, as well as strong presence from the United Arab Emirates (with the 3 national pavilions located in the same Hall). Greek industry is also well represented, showcasing a range of interesting unmanned aerial and naval systems.

This year’s edition comes in the wake of Greece’s recently announced €25 billion defense investment plan, set to run through 2036. With formal contracts now expected, industry observers sense that this round of procurement will be backed by tangible financial commitments. As part of its broader strategic positioning under the ReArm Europe initiative, Athens has requested to allocate an additional 1.5% of GDP in defense without impacting its deficit calculations.

The primary focus of the Hellenic Armed Forces’ modernization mirrors what has been proclaimed in the last few years, with renewed momentum for naval acquisitions—specifically additional frigates and submarines. While plans for new corvettes appear to have shifted into a longer-term horizon, the frigate program is getting significant attention. Despite well-established requirements, no final decision has been made, leaving room for multiple outcomes.

Leading candidates in the frigate competition include 3 additional FDI frigates (KIMON class) from Naval Group and 2 second-hand FREMM frigates from Fincantieri—namely the BERGAMINI (General Purpose) and FASAN (Anti-Submarine Warfare)—currently serving with the Italian Navy. Although there has also been some reported interest in the U.S.-built CONSTELLATION-class, their high cost and tailored design for the U.S. Navy makes this option less likely.

In the land domain, the Hellenic Army is preparing for a significant modernization effort. This includes the planned procurement of approximately 200 tracked infantry fighting vehicles (IFVs), expected to be Rheinmetall’s LYNX, and around 100 wheeled IFVs, where KNDS’s 8x8 VBCI PHILOCTETES remains the front-runner. Additionally, Greece is looking to acquire a new fleet of utility vehicles and logistics trucks, with Iveco Defence Vehicles (IDV) considered a strong contender in both categories.

Greek industry, for its part, is playing an increasingly active role. EODH continues to support upgrades for the M113, LEONIDAS, and LEOPARD 1/2 platforms. Meanwhile, Metlen has signed Memoranda of Understanding with both IDV and KNDS, targeting involvement in future army modernization programs. Across both land and naval sectors, there is a concerted effort by domestic firms to forge partnerships with major European defense players, aiming to secure a deeper role in upcoming programs.